Private loans are quick changing into one of many most well-liked financing choices. You may borrow a big amount of cash, finance it over a number of years with each a hard and fast rate of interest and month-to-month fee. You can even use the cash for almost any objective. The most well-liked is debt consolidation–rolling a number of high-interest bank cards right into a single, decrease price installment mortgage. However you may as well use these loans to buy a automobile, begin a enterprise, make house enhancements, or pay for a marriage, trip, or giant, out-of-pocket medical bills.

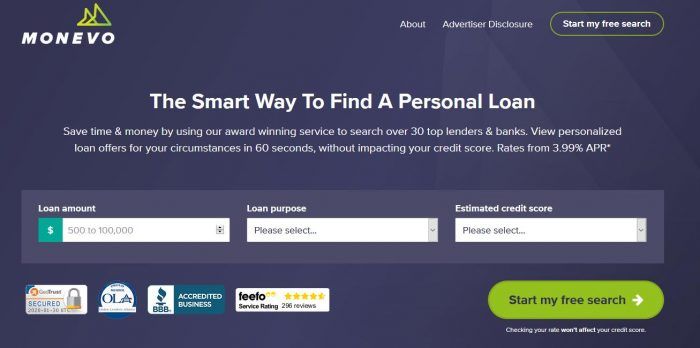

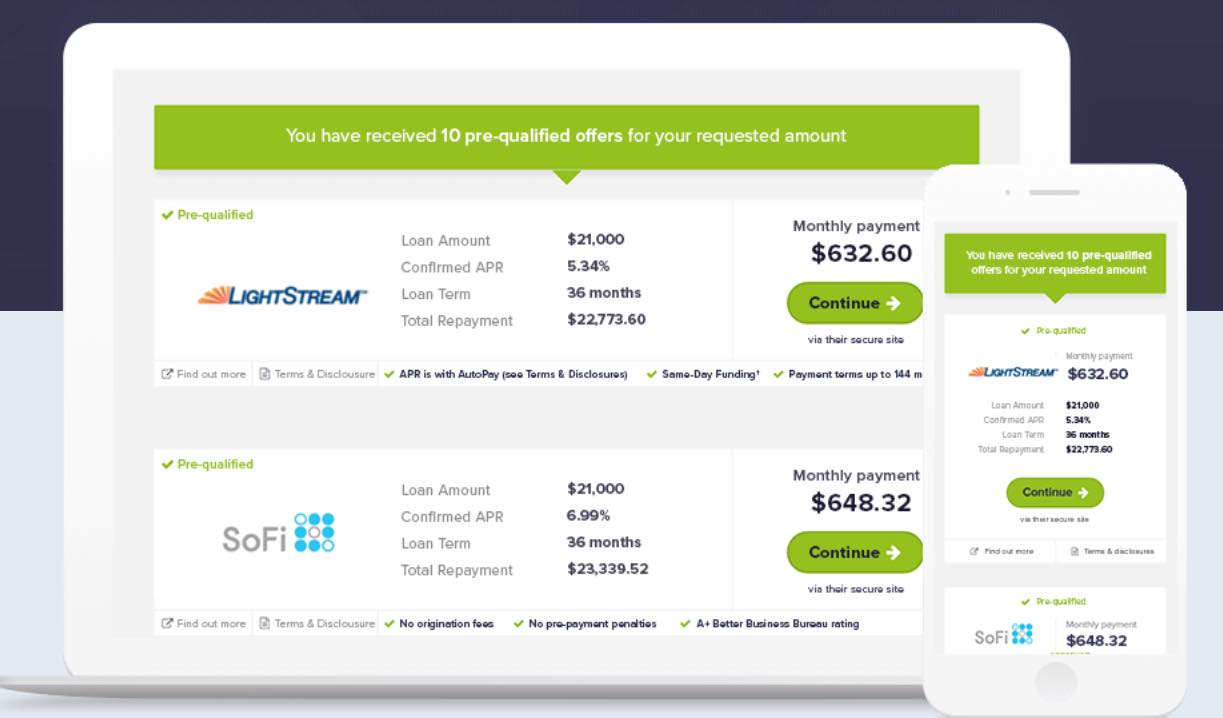

There at the moment are dozens of on-line corporations, banks and credit score unions providing private loans, all beneath totally different phrases. However a web based platform like Monevo gives you with a possibility to seek for a number of private mortgage lenders on the identical time. After filling out a web based kind, you possibly can obtain presents from collaborating lenders. The businesses Monevo works with are a number of the greatest within the business.

Monevo places the facility of competitors at your fingertips. If you happen to’d fairly simply fill out one kind for a private mortgage and await the lenders to return to you, Monevo is a platform the place you are able to do it.

In This Article:

- Who and What’s Monevo?

- Monevo Mortgage Particulars

- Monevo Options and Advantages

- Monevo Curiosity Charges and Charges

- The Monevo On-line Course of

- Monevo Execs and Cons

- Monevo Options

- Monevo Private Loans FAQs

- Ought to You Use Monevo to Seek for Private Mortgage Choices?

Who and What’s Monevo?

With U.S. operations based mostly in San Diego, California, Monevo is a web based private mortgage market–a one-stop store. The corporate studies participation from greater than 30 lenders and banks, offering mortgage companies to greater than 250,000 customers every month, funding greater than $1 billion.

And that’s simply from its operations in the US. It’s really Europe’s largest lending market, with participation from greater than 150 lenders. The corporate at the moment operates primarily in Australia, Poland, the U.S. and the UK, funding roughly $10 billion in loans monthly.

The corporate started operations within the U.S. early in 2017, however received its begin within the UK in 2009.

Monevo has a Higher Enterprise Bureau score of “A+”, the best on a scale of A+ to F. It has been accredited by the Bureau since early 2018.

Monevo Mortgage Particulars

Loans accessible: Private loans, with fastened rate of interest and mortgage phrases, and no collateral required. Nevertheless, a number of the collaborating lenders do provide different varieties of loans.

Minimal/most mortgage quantities: $500 to $100,000

Mortgage phrases: 3 months to 144 months (12 years)

Mortgage charges: No charges payable to Monevo; see Monevo Curiosity Charges and Charges part beneath for basic price and payment ranges charged by particular person lenders.

Required credit score vary: Truthful to wonderful (credit score rating of 600 to 850). Nevertheless, Monevo studies choices can be found for all credit score scores, however it’s best to count on presents to be much less quite a few you probably have poor credit score.

Mortgage functions: Debt consolidation, house enchancment, trip, autos, giant purchases, paying off bank cards, scholar mortgage refinancing (not accessible with all collaborating lenders), schooling, particular events, beauty procedures, shifting and relocation, family bills, medical and dental bills, taxes, business-related functions and different makes use of.

Mortgage funds disbursement: The web site signifies you possibly can obtain your mortgage funds as early as the following enterprise day after approval.

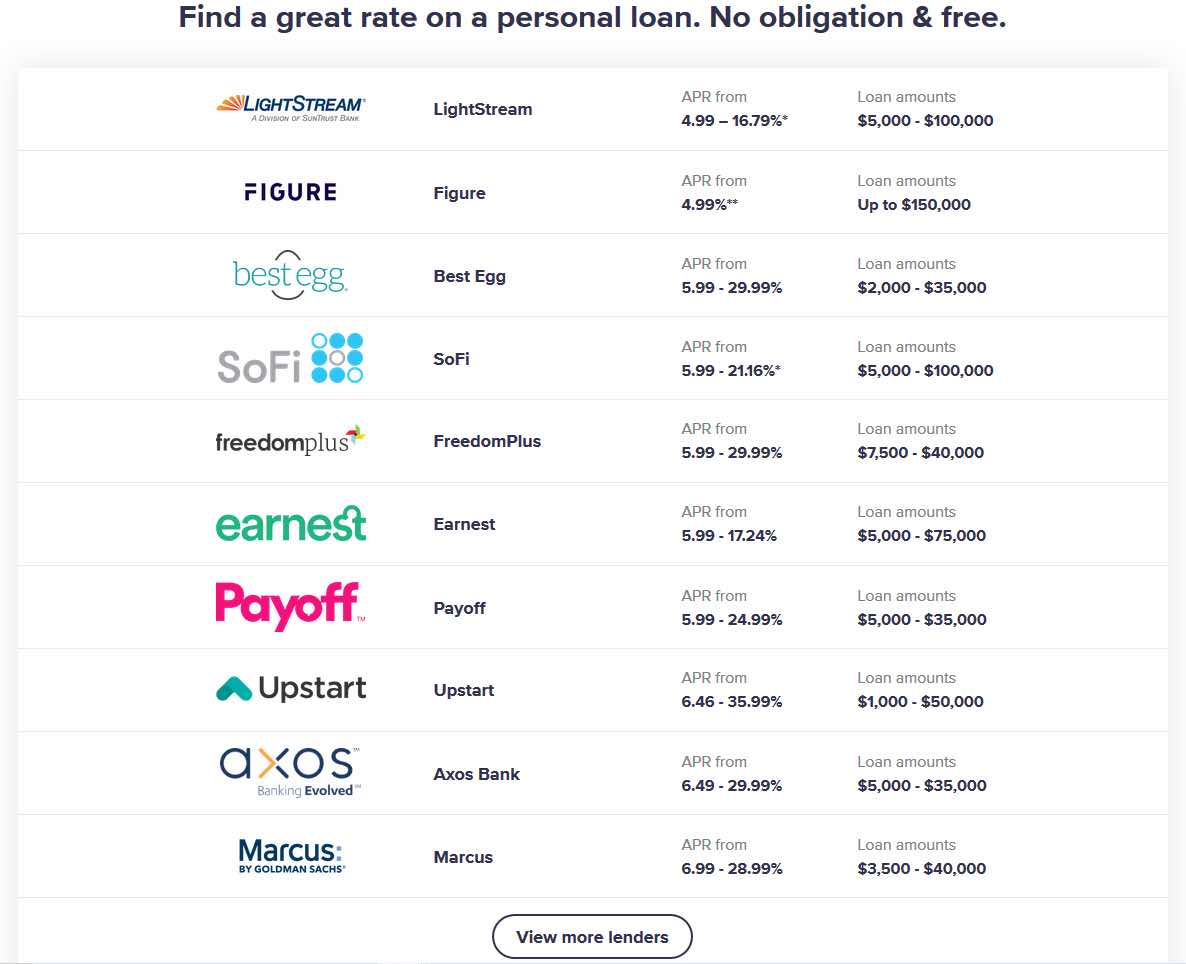

Taking part lenders: 30+, together with LightStream, Finest Egg, SoFi, Upstart, Marcus by Goldman Sachs, Prosper, Lending Membership, Avant and lots of others.

Monevo Options and Advantages

“Tender credit score pull”: Once you use the Monevo service, a comfortable credit score test is finished, which won’t impression your credit score rating. Nevertheless, in case you comply with proceed with a proper utility with any lender collaborating on the web site, a tough pull will likely be carried out, leading to a minor unfavorable impression in your credit score rating.

Course of: On-line kind solely–there isn’t any possibility to make use of the Monevo service over the phone

Monevo safety: The web site makes use of Safe Socket Layer (SSL) encryption expertise with the transmission of all delicate knowledge over the Web. In addition they use firewalls to stop exterior entry into their community. Entry to your private data is proscribed to workers, contractors, service suppliers and brokers who want the data to function, develop or enhance the service.

Customer support: Contact is out there by electronic mail and reside chat solely. However it’s vital to do not forget that Monevo is just a web based mortgage market and never a direct lender. They will be unable to help you with particular points referring to your mortgage utility with a direct lender.

NOTE: Although Monevo customer support is proscribed, you should use the Monevo service to seek for a mortgage on a 24/7 foundation, and obtain leads to beneath 60 seconds.

Monevo Curiosity Charges and Charges

There isn’t any payment required for utilizing the Monevo web site. The location earns commissions paid by lenders solely on loans which have been authorized and funded.

Monevo signifies rates of interest starting as little as 3.49% APR to 35.99% APR. The precise rate of interest you’ll obtain will rely in your credit score rating, the mortgage quantity requested, mortgage objective, your debt-to-income ratio, and different components. As well as, credit score analysis standards will range from one lender to a different.

The principle payment concerned in private loans is an origination payment. It would usually vary between 1% and 6% of the mortgage quantity obtained, and can solely be paid upon disbursement of your mortgage proceeds.

For instance, in case you take a $10,000 mortgage with a 6% origination payment, you’ll obtain web proceeds of $9,400. This would be the $10,000 face quantity of the mortgage, minus $600 for the origination payment. You’ll, after all, be chargeable for repaying the complete $10,000 mortgage quantity.

Different charges will rely upon the precise lender, however you usually won’t be charged an utility payment or a prepayment penalty in case you repay your mortgage early.

The Monevo On-line Course of

As soon as once more, all the course of takes place on-line. To be eligible, you have to be a U.S. citizen or everlasting resident, be a minimum of 18 years of age, and have a sound checking account in your identify.

The method begins with pre-qualification. You’ll present three items of data–the mortgage quantity requested, mortgage objective, and your estimated credit score rating vary.

Then, you’ll obtain a one-page kind that may request the next data:

- Your full identify

- Date of beginning

- E mail handle

- Main and secondary telephone numbers

- Highest schooling stage accomplished

- Point out in case you personal your automotive free and clear

- Point out if you want so as to add a co-borrower (in that case, that occasion must provide comparable data)

- Your full handle

- Sort of residence

- Month-to-month housing fee

- Time at that handle

- Employment standing (employed, retired, self-employed, scholar, unemployed)

- Annual gross revenue

- Your Social Safety quantity

When you submit your mortgage request, you’ll start receiving mortgage presents from numerous lenders inside 60 seconds. Nevertheless, the web site does warn that they can’t assure that everybody will obtain presents.

You may choose the mortgage provide that’s most agreeable to you, then full the applying course of with that lender. In doing so, the lender is prone to request extra data. This may embody (however shouldn’t be restricted to) revenue documentation, repay statements for any loans you need paid off via the brand new mortgage, earlier employment or residence data, or some other data required by the lender.

You’ll be offered with all phrases and crucial paperwork referring to the mortgage you’ve accepted. Funding will happen as early as the following enterprise day, however does range by lender.

Monevo Execs and Cons

Execs:

- As a web based private mortgage market, Monevo provides you entry to greater than 30 direct lenders.

- Taking part lenders are a number of the greatest names within the private mortgage house.

- You may borrow as a lot as $100,000, when it comes to as much as 12 years.

- Mortgage proceeds could be accessible as early as the following enterprise day after closing.

- The location is totally free to make use of, so there isn’t any value to you in case you don’t get the mortgage you need.

- Utilizing the Monevo service begins with a comfortable credit score pull, which won’t negatively have an effect on your credit score rating.

- Monevo has the best score doable from the Higher Enterprise Bureau.

Cons:

- Monevo shouldn’t be a direct lender, so they are going to solely be capable to present restricted help in using the location, not for points with the direct lenders.

- Your financing choices could also be restricted you probably have honest or poor credit score.

- Monevo doesn’t provide telephone contact or the flexibility to use for a mortgage by telephone.

Monevo Options

It’s simple that on-line private mortgage marketplaces like Monevo are one of many best sources of this kind of financing. However in case you desire to strive various sources, contemplate any of the next:

- Prosper is the second-largest impartial on-line private mortgage lender within the private mortgage business. Not like Monevo, they’re a direct lender. As one of many business leaders, they provide a number of the most modern private loans within the business.

- SoFi is greatest recognized for offering scholar mortgage refinances. However they’ve branched out into different varieties of financing, together with private loans. As a specialised lender, they typically desire debtors with stronger credit score profiles. However they can even look carefully at your revenue, schooling, and occupation, fairly than relying solely in your credit score rating.

If you happen to’re on the lookout for one other on-line private mortgage market, take a look at Even Monetary. They provide comparable private loans as Monevo, together with mortgage quantities as much as $100,000, with rates of interest beginning as little as 4.99%. However don’t be stunned in case you see most of the identical lenders collaborating within the Even Monetary web site as you do on Monevo!

Monevo Private Loans FAQs

? ? Why ought to I seek for a private mortgage via Monevo, fairly than immediately with numerous private mortgage lenders?

Once you use a web based market like Monevo, you’re placing numbers to be just right for you. Fairly than merely inquiring about financing via a single lender, your data will likely be accessible to 30 or extra direct lenders. This can even assist you to keep away from the effort and time spent making use of on to looking out a number of lenders individually. ? ? How come a comfortable credit score pull gained’t harm my credit score rating? If it doesn’t, how efficient is it for the lenders?

A comfortable credit score pull is a particular class of credit score inquiry. It takes place whenever you pull your individual credit score rating, or whenever you authorize a lender or different occasion to make an inquiry. It provides the lender sufficient data to start the prequalification course of with out having to make a tough inquiry that may negatively have an effect on your credit score rating. Nevertheless, in case you make a proper utility to any lender on the Monevo platform, a tough credit score pull will in the end be carried out. ? ? Why do I want to supply checking account data if I’m making use of for a mortgage?

With a view to obtain your mortgage proceeds as early as the following enterprise day, the ultimate lender you choose will want a checking account to wire the funds into. This data will have to be equipped at utility in order that the wire could be carried out instantly. As well as, many private mortgage lenders will present a reduced price – usually 0.25% – in case you authorize computerized draft funds out of your checking account. It’s a less expensive fee assortment methodology for the lenders, and extra handy for you because you gained’t have to write down a test each month. ? ? You’ve indicated Monevo can’t assure that I’ll get a mortgage approval. Ought to I be hesitant to make use of the service in any respect?

It’s not solely Monevo that may’t assure a mortgage approval. First, Monevo shouldn’t be a direct lender and doesn’t have approval authority. Second, approval will likely be decided based mostly on the collaborating lenders. That approval will likely be based mostly on quite a few components, together with your credit score rating, the soundness of your revenue, the quantity of debt you’re carrying, your debt-to-income ratio, and even the aim of the mortgage you’re taking. Aside from private loans, just about no non-government sources can assure anybody will likely be authorized for financing. That applies to mortgages, non-public scholar loans, auto loans, enterprise loans and bank cards, in addition to private loans.

Ought to You Use Monevo to Seek for Private Mortgage Choices?

Private loans are shortly changing into a most well-liked financing supply. That’s as a result of they provide the next benefits:

- They’re fully unsecured–you don’t must pledge any collateral to get financing.

- Each the rate of interest and your mortgage time period are fastened, so your fee won’t ever change.

- Since every mortgage has a particular time period, it will likely be paid off on the finish of that time period. That is fully not like bank cards, which may proceed for years and years.

- Private mortgage proceeds can be utilized for almost any objective.

- Private loans could be a wonderful method to consolidate high-interest bank card debt, or to acquire financing for a enterprise. Small companies, particularly upstarts, have nice problem getting conventional enterprise loans.

As useful and versatile as private loans have turn into, a web based private mortgage market–like Monevo–is one of the simplest ways to get one:

- You may search presents from one in all greater than 30 private mortgage lenders on the platform.

- You may solicit mortgage presents from a number of lenders with out affecting your credit score rating. A tough credit score pull will solely be carried out in case you select to go together with a selected lender.

- You may search from the consolation of your private home or office–there’s no must go to a lender’s workplace.

- There isn’t any value to make use of the Monevo web site.

- You may seek for a mortgage on a 24/7 foundation.

You may consider Monevo because the mortgage equal of going to the mall–as soon as there, you’ll have many choices to take your corporation. It would even put the lenders in competitors with each other for your corporation. And since there isn’t any payment or credit score penalties to go looking pre-qualified mortgage presents, all the course of is totally risk-free.

If you happen to’d like extra data, or to see your customized outcomes, go to the Monevo web site.

,